- NAVIGATING Futures, Transforming Careers

- Trichy

Our Features

RTMS Registration & Recognition

Embassy Attestation Model

Foreign Embassy Attestation

Reason to get Attestation

Attestation for Public Document

The Following Countries are accepted our Attestation

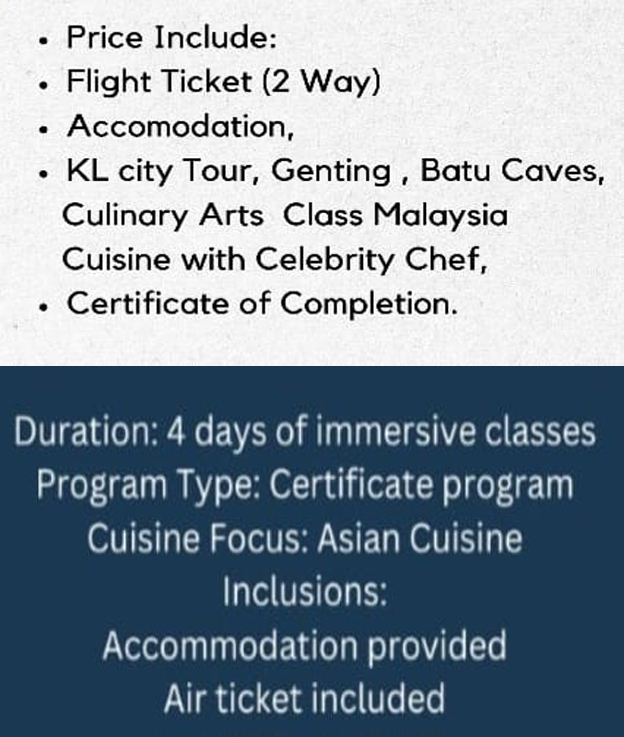

International Training Program

Register with Employment Exchange

An Employment exchange is an organization that provides employment assistance on the basis of qualification and experience. The departments of Employment in various states of India allow unemployed educated youth residing in the respective states to pre register for impending job vacancies occurring in different sectors of that states.

Employment Exchange have been renamed as “ Employment Guidance and Promotion Centres” as the focus is now on vocational guidance and career counseling besides registration, submission placement etc. Employers can post their vacancies with employment exchanges and choose from among the registered candidates as per their requirements.

Establishment in the private sector employing between 10 – 24 persons are being brought under the purview of the Act The employoment exchanges ( Complulsory Notification of Vacancies Act ) 1959 for the purpose of submission of returns. This is likely to result in a more realistic estimate of employment in the organized sector. The employer is being mandated to furnish information relating to the result of selection against the vacancies notified within thirty days from the date of selection, to make the registration data more rational. The definitions of employee and employer are being broad based to include contract labour who have worked for more than 240 days in the year.

Online Registration

• Please visit State Employment Exchange website for online registration.

• If you are not registered member you need to register to create your account.

• Log in to state Employment Exchange website with your credentials.

• Select the district name, In case of certain states, your native state and district details are also asked for. Hence follow the instructions give in the respective state portal.

• Fill the profile form. On submission of the form an acknowledgement containing the Registration Number, Registtration Date and Name of the Employment exchange is generated.

• This acknowledgement may be printed and kept for future reference.

• Produce all relevant certificates in support of education, experience, caste sports, handicapped ( issued by medical board / CMO), Ex serviceman, widow freedon fighter and proof of residence etc. to the Employment Exchange mentioned within 15 days from the date registration. This time limit may vary from state to state.

• Apart from the above documents you need to submit one of the following document as residence proof.

• Proof of job in the State of either of the parents.

• Certificate of education in the state.

• Letter from gazette officier or school head.

• Certificate issued by an MLA /MP.

• Domicile Certificate.

• Finally, Employment exchange will issue you a registration card carrying Registration no with date of renewal of that registration.

Offline Registration

Note : For offline registration , users will have to visit their nearest employment Exchange with all up to date qualilfication documents and experience certificates.

• Visit nearest employment exchange office in your area of residence and fill up the required application form.

• Submit attested photocopies of all your up to date education and experience related certificates along with your resume.

• Caste certificate ( Optional ) and photographs.

• Experience certificate if you have.

• Produce any one of the following identity documents.

• Voter’s Identity card.

• Ration card.

• Passport.

Tax Exemption

1. Is educational services exempt from GST?

GST Law recognizes this and provides exemption to educational institutions, providing education up to higher secondary school or equivalent from the levy of GST.

2. Is education tax free in India ?

The Indian Government permits individuals to claim deductions for tuition fees paid on behalf of their children. The provision for tuition fee tax benefit is discussed below ; Section 80 C. The maximum deduction limit permitted under section 80 C is Rs. 1.5 lakhs.

3. What are the tax incentives for education institutions ?

Tuition and education fees are eligible for tax benefits in india. Deductions of up to Rs 1.5 lakh can be clained based on this. There are different eligibility criteria for different payments as well as certain payment that are not eligible.

4. Is GST applicable for educational institutions ?

Services provided to educational institutions exempt from GST. The GST Act tries to maintain a fine balance whereby core educational services provided and received by educational institutions are exempt and other services are sought to be taxed at the standard rate of 18 %.

5. What is the meaning od education services ?

Educational services provide training or instruction based learning on any subject to students or other individual requiring it. Generally, educational establishments like schools or colleges offer the services. However, private and public – owned organization may provide the same.